Social media payments have emerged as a transformative force in the digital landscape, reshaping the way individuals and businesses exchange money, transact, and engage in online commerce. This innovative financial technology combines the ubiquity of social media platforms with the convenience of digital payments, creating a seamless and interconnected ecosystem.

At its core, social media payments refer to the integration of payment processing and money transfer functionalities within popular social networking sites and messaging apps. This integration allows users to send money, make purchases, donate to causes, or even split bills without ever leaving the platform. The appeal of social media payments lies in its simplicity and the ability to complete financial transactions while engaging with friends, family, and followers.

Key players in this space include Facebook (now Meta Platforms, Inc.), which launched its digital wallet, Novi, and is working to enable payments across its suite of apps. Other platforms like WhatsApp, Instagram, and Twitter are also exploring or implementing in-app payment features. Furthermore, China’s WeChat and Alipay have set the standard for social media payments, illustrating how they can revolutionize e-commerce and peer-to-peer transactions.

As social media payments continue to evolve and gain prominence, they pose both opportunities and challenges, such as privacy and security concerns, regulatory compliance, and market competition. Nevertheless, the fusion of social media and payments is reshaping the way we interact, shop, and manage our finances in the digital age.

Here are some of the key points to remember…

Convenience and Integration

Convenience and integration are at the heart of the transformative impact of social media payments. This emerging financial technology has revolutionized the way individuals and businesses engage in online commerce and manage their financial transactions. The seamless integration of payment processing within popular social networking platforms provides users with unprecedented ease and efficiency in their day-to-day financial interactions.

One of the primary advantages of social media payments is the elimination of the need to switch between multiple apps or websites to perform financial transactions. Users can send money, make purchases, split bills, or contribute to fundraisers without leaving the comfort of their preferred social media platform. This streamlined approach simplifies the user experience, reducing friction and saving time.

Furthermore, the integration of payment features directly within social media apps has significantly broadened the scope of these platforms. Users can not only interact with friends, family, and followers but also conduct business, purchase products, sign up and pay for events, and support charitable causes without the hassle of navigating external websites or payment gateways.

Convenience is a driving force behind the popularity of social media payments, as users are drawn to the idea of performing transactions with just a few taps or clicks within the apps they already use daily. However, as this trend continues to evolve, it also raises important questions about data security, privacy, and regulatory compliance, which must be carefully addressed to ensure the continued success and trustworthiness of social media payment systems.

Key Players

Key players in the realm of social media payments are companies and platforms that have successfully integrated financial transactions into their social networking services. These players are at the forefront of shaping the future of digital payments and e-commerce. Here are some notable key players in social media payments:

- Meta Platforms, Inc. (formerly Facebook): Meta, which owns Facebook, Instagram, and WhatsApp, has been a major player in social media payments. They have developed Novi, a digital wallet, and have been working on enabling payments across their suite of apps.

- Twitter: Twitter has been exploring in-app payment features and partnerships to facilitate seamless transactions and payments for users.

- WeChat: A Chinese messaging app, WeChat has set the standard for social media payments with its integrated payment solutions. Users can perform a wide range of financial transactions through the app.

- Alipay: Another Chinese giant, Alipay, offers a comprehensive range of payment and financial services within its app, including mobile payments, investments, and lending.

- PayPal: While not a social media platform in the traditional sense, PayPal is often integrated into social media sites and is widely used for peer-to-peer payments and online shopping.

- Snapchat: Snapchat has introduced a feature called Snapcash, which allows users to send money to friends directly through the app.

- Line: A popular messaging app in Asia, Line offers integrated payment solutions and has expanded into various financial services.

- KakaoTalk: Similar to Line, KakaoTalk is a South Korean messaging app with integrated payment features and a digital wallet.

- Telegram: Telegram offers a bot platform that allows developers to create payment solutions, and users can make payments within the app.

- Google Pay and Apple Pay: These mobile payment platforms are often integrated into various social media apps, allowing users to make in-app purchases and transactions.

These key players are actively shaping the landscape of social media payments, leveraging their extensive user bases and technological expertise to make financial transactions more convenient and accessible for people around the world.

Global Reach

Social media payments have ushered in a new era of global financial connectivity, extending the reach of digital transactions and commerce to an unprecedented scale. With social media platforms used by billions of people worldwide, the global reach of social media payments is a defining feature of this financial technology.

One of the most significant advantages of social media payments is their ability to facilitate cross-border transactions. Users can send money, make purchases, and engage in financial transactions with individuals and businesses from different countries, all within the familiar environment of their preferred social media platforms. This has greatly simplified the process of international remittances, e-commerce, and cross-border peer-to-peer transactions.

Furthermore, the widespread adoption of social media platforms ensures that social media payments are accessible to a diverse global audience. This inclusivity is particularly important in regions with limited access to traditional banking services, as it provides a more straightforward and cost-effective means of financial engagement.

The global reach of social media payments also plays a pivotal role in fostering economic and financial integration on a global scale. It has the potential to break down barriers to trade and financial inclusion, connecting people and businesses across borders and cultures. However, it also raises regulatory and security challenges that require international cooperation and standardization to ensure the safety and trustworthiness of these cross-border transactions.

P2P Transactions

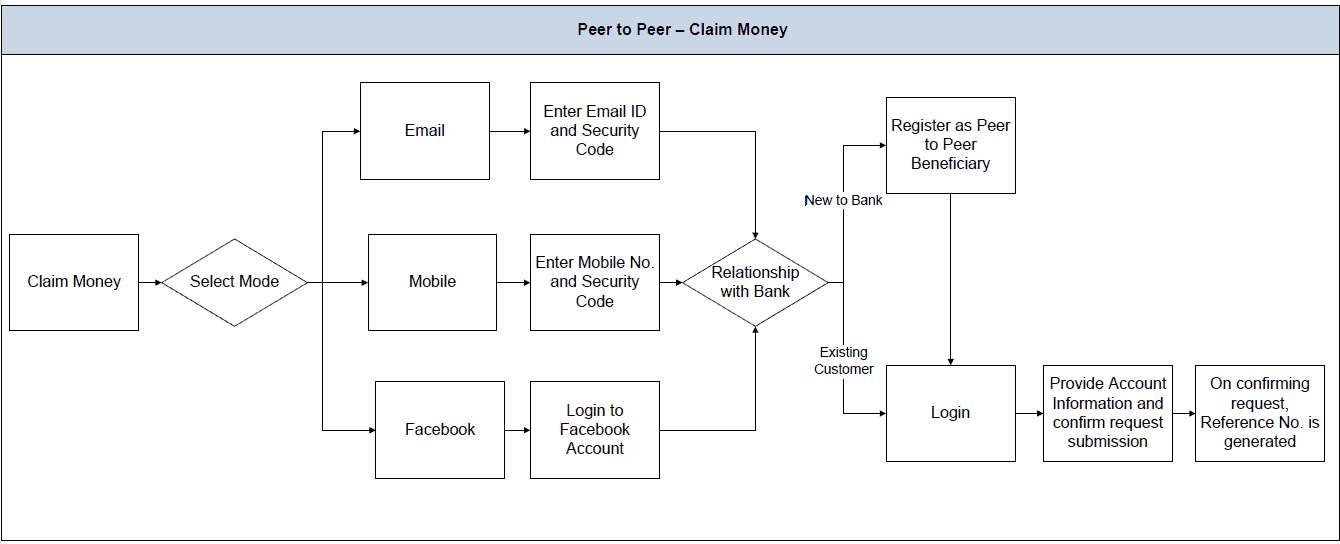

Peer-to-peer (P2P) transactions are a cornerstone of the evolving landscape of social media payments, fundamentally changing the way individuals transfer money, split bills, and engage in financial interactions with friends and family. P2P transactions within social media platforms enable users to send and receive money directly to and from their contacts, making the exchange of funds as simple as sending a message.

One of the primary advantages of P2P transactions on social media is the seamlessness they offer. Users can initiate a money transfer or payment within their favorite social networking app, often by linking a bank account or debit card. This convenience eliminates the need for third-party financial apps or traditional methods of transferring money, streamlining the entire process.

Additionally, P2P transactions are often instantaneous, providing quick access to funds, which is particularly useful in situations like splitting a restaurant bill, sharing rent, or sending a birthday gift. Many social media payment platforms also offer features like transaction history, notifications, and payment request options, enhancing the overall user experience.

While P2P transactions on social media provide unparalleled convenience, they also raise important considerations regarding privacy and security. Users must be vigilant about protecting their financial information and choosing platforms with robust security measures in place to ensure the safety of their transactions. As social media payments continue to evolve, the P2P feature is expected to further simplify financial interactions among friends and family, ultimately reshaping the way we handle personal finances and social financial engagements.

E-commerce Integration

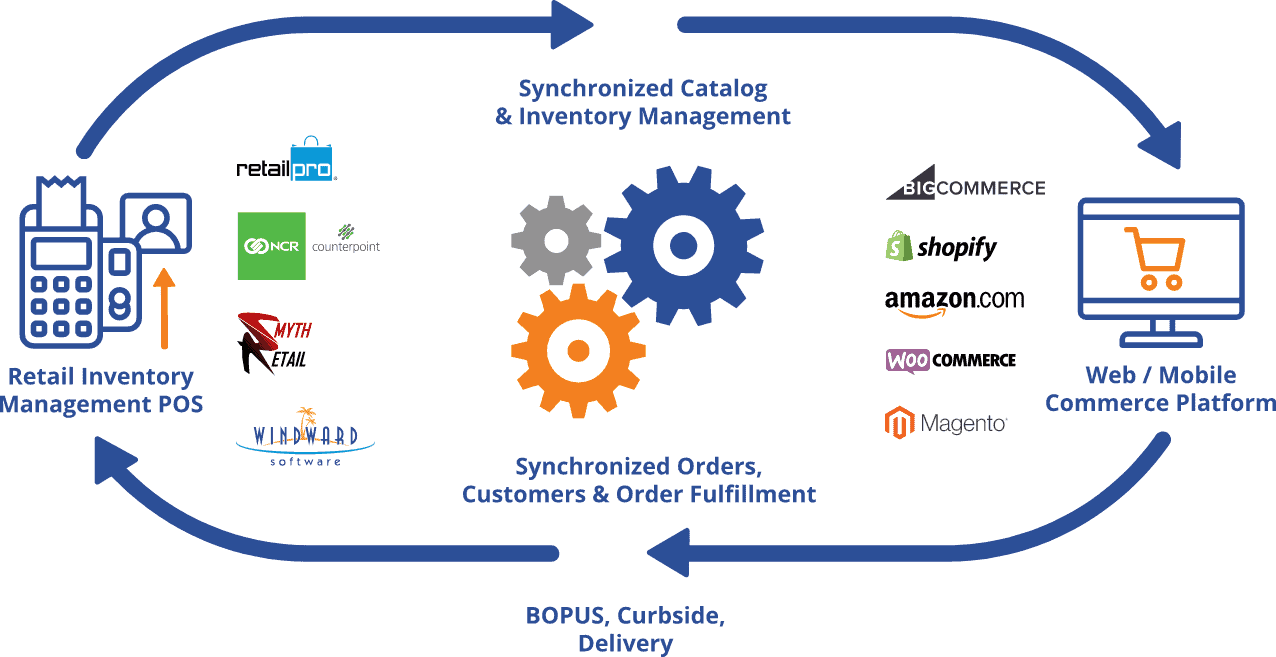

E-commerce integration within the realm of social media payments is a transformative development that is redefining the way people shop and conduct business online. This integration allows users to seamlessly make purchases and transactions while remaining within their preferred social media platforms, offering a frictionless shopping experience.

Social media platforms with e-commerce integration enable users to discover, explore, and buy products directly within the app, bridging the gap between product discovery and purchase. This not only simplifies the buying process but also enhances the visibility of products and services for businesses.

Key features of e-commerce integration on social media payments include “Shop Now” buttons, in-app storefronts, and the ability to showcase products with detailed descriptions, images, and even videos. Users can read reviews, interact with sellers, and make secure payments, all without leaving the social platform.

For businesses, this integration provides a direct line to potential customers, leveraging the vast user bases and extensive data analytics capabilities of social media platforms to target the right audience. It has become an indispensable tool for small and large businesses alike, offering a convenient way to increase sales and enhance brand exposure.

As social media payments continue to evolve, e-commerce integration represents a significant shift in how people engage with online businesses. However, it also poses challenges, such as data security and privacy concerns, which must be carefully addressed to maintain user trust and the continued success of these integrated e-commerce features.

Donations and Fundraising

Donations and fundraising on social media payments have become a powerful force for charitable causes, non-profit organizations, and individuals seeking to make a positive impact. This innovative feature allows users to contribute to charitable organizations and fundraisers seamlessly through their preferred social media platforms.

Social media payments have simplified the process of giving back by integrating donation buttons and features that enable users to support causes they care about with just a few clicks or taps. Users can contribute to campaigns, charities, and personal fundraisers, making philanthropy accessible to a wide audience.

The speed and reach of social media platforms make it easier for fundraisers to gain visibility and support. Users can share fundraisers and invite their friends and followers to participate, creating a network effect that can significantly boost donations. In addition, these platforms often provide tools for fundraisers to track progress, share updates, and express gratitude to donors.

For charitable organizations, social media payments offer a direct and cost-effective way to collect donations and expand their donor base. The simplicity of the process encourages more people to get involved and contribute to various causes, making it a pivotal tool for both well-established and grassroots charitable efforts.

The integration of donations and fundraising on social media payments is not only reshaping philanthropy but also highlighting the importance of social networking in mobilizing support for a wide array of causes, from disaster relief to medical expenses to education initiatives. However, it is crucial to address transparency, accountability, and security concerns to maintain public trust in these charitable endeavors.

Security Concerns

Security concerns are a paramount issue in the realm of social media payments, as the integration of financial transactions within social networking platforms introduces unique challenges and risks. These concerns revolve around safeguarding sensitive financial and personal information, ensuring the integrity of transactions, and protecting users from fraud and cyberattacks.

One of the primary security concerns is data protection. Social media platforms handle a vast amount of user data, including financial information, and the safe storage and transmission of this data are critical. Encryption, secure server protocols, and stringent data protection measures are essential to prevent data breaches and unauthorized access.

Privacy is another significant concern. Users must trust that their financial transactions and personal information are kept confidential and not misused. Social media companies need to establish and enforce robust privacy policies, providing users with control over what information is shared and with whom.

Financial fraud and scams are ongoing threats. Cybercriminals may attempt to deceive users into making false transactions or disclosing personal information. Implementing fraud detection systems and educating users about common scams is vital.

Regulatory compliance is a challenge, as different regions may have varying rules and requirements for financial services and payments. Companies offering social media payments need to navigate these complex regulatory landscapes to ensure they meet legal obligations.

In summary, while social media payments offer incredible convenience, they also raise substantial security concerns. Ensuring the security and privacy of users’ financial data and transactions is a critical priority for both social media platforms and the users themselves. Collaboration between these platforms, users, and regulators is necessary to establish a secure and trustworthy environment for social media payments.

Regulatory Challenges

Regulatory challenges are a significant hurdle in the rapidly evolving landscape of social media payments, as they encompass a complex web of legal, financial, and privacy considerations. These challenges arise from the integration of financial transactions into social media platforms and the need to ensure that these transactions comply with regional and international regulations.

One of the primary regulatory concerns is related to financial services licensing and oversight. Many countries require entities engaging in financial activities to obtain licenses and adhere to strict regulations to protect consumers and prevent money laundering. Social media platforms offering payment services must navigate these regulations, which can be intricate and vary widely from one jurisdiction to another.

Data protection and privacy laws also come into play. Social media companies need to handle users’ personal and financial data responsibly and transparently, adhering to regulations like the European Union’s General Data Protection Regulation (GDPR) and similar laws in other regions.

Anti-money laundering (AML) and know-your-customer (KYC) regulations are another challenge. Social media payments must incorporate robust AML and KYC measures to prevent illicit financial activities and ensure the identity of users.

Interoperability and cross-border transactions introduce additional regulatory complexities. International money transfers and currency exchange can trigger regulatory concerns regarding foreign exchange rates and compliance with international financial laws.

Overall, the regulatory landscape for social media payments is a dynamic and evolving one. As the integration of payment services within social media continues to grow, collaboration between technology companies and regulators is vital to strike a balance between innovation and compliance, ensuring the safety and security of users’ financial activities.

Monetization Strategies

Monetization strategies in the realm of social media payments are pivotal for both social media platforms and businesses. These strategies encompass various approaches to generate revenue from the integration of payment services within social networking apps:

- Transaction Fees: One of the most straightforward monetization methods involves charging a fee for each transaction made through the platform. Social media companies may levy a percentage-based fee on the transaction amount or a fixed fee for certain services, such as money transfers.

- Advertising: Social media platforms can generate revenue by incorporating advertising into their payment interfaces. This can include sponsored payment suggestions, targeted product recommendations, or ads from businesses looking to reach a specific audience.

- Partnerships: Collaborations with financial institutions, payment processors, or e-commerce companies allow social media platforms to earn commissions or referral fees for promoting and facilitating their services.

- Premium Features: Offering premium or advanced features, such as expedited money transfers, enhanced security options, or exclusive discounts, for a subscription fee can be a lucrative monetization approach.

- Data and Analytics: Social media companies can monetize transaction data and user behavior analytics by selling insights and anonymized data to businesses seeking to better understand consumer preferences and trends.

- Loyalty Programs: By incorporating loyalty programs or rewards for users who frequently engage with social media payments, companies can encourage increased usage and generate revenue through partnerships with participating businesses.

- Subscription Models: Some platforms may choose to offer subscription models for access to premium payment features, prioritized customer support, or enhanced financial tracking tools.

These monetization strategies not only allow social media platforms to generate revenue but also help sustain the integration of social media payments and motivate businesses to utilize these platforms for e-commerce. However, they must be implemented carefully to strike a balance between profitability and user satisfaction, ensuring that the convenience and utility of social media payments are not compromised.

Market Potential

The market potential for social media payments is immense, as it continues to reshape the way individuals and businesses conduct financial transactions in the digital age. This transformative technology can revolutionize e-commerce, peer-to-peer transactions, and financial engagement across the globe.

One of the driving forces behind this market potential is the vast user base of social media platforms. Billions of users worldwide engage with these platforms daily, presenting an expansive audience for the integration of payment services. This broad reach is particularly promising for businesses, as it offers a direct channel to connect with potential customers.

Furthermore, the convenience and accessibility of social media payments make them appealing to a wide range of users. The ease of sending money, making purchases, and participating in fundraisers within familiar social media environments simplifies financial interactions. As a result, it is not only tech-savvy users but also individuals and businesses that previously had limited access to digital financial services who stand to benefit.

While the market potential is vast, it is not without challenges. Security and privacy concerns, regulatory compliance, and competition within the market are important considerations. Nevertheless, the continued growth and innovation in the field of social media payments make it a dynamic and promising sector, poised to play a significant role in the future of online commerce and financial engagement.

Final Thoughts on Social Media Payments

In conclusion, social media payments represent a significant paradigm shift in how people interact, transact, and manage their finances in the digital age. The fusion of social media and financial technology offers unparalleled convenience, integration, and accessibility. Users can seamlessly send money, make purchases, split bills, donate to causes, and engage in e-commerce within the familiar confines of their favorite social media platforms.

Key players like Meta Platforms, Twitter, and various international apps have led the way in this transformation, offering a broad array of financial services. This market’s potential is vast, thanks to the massive user base and global reach of these platforms, making it attractive for businesses, charitable organizations, and individuals.

Yet, social media payments also pose challenges, including security and privacy concerns, regulatory complexities, and the need for international cooperation to ensure a trustworthy environment. As the market evolves, it’s essential to strike a balance between innovation and compliance, safeguarding the integrity of financial transactions and user data.

In essence, social media payments have the power to foster financial inclusion, streamline global commerce, and revolutionize philanthropy. The future holds exciting possibilities as the integration of social media and finance continues to evolve, reshaping our digital and financial landscapes.