In case you need somebody to tell you this: in business, you want to earn more than you spend. That’s what getting returns means.

Return on investment (ROI) is a very popular metric used to answer a simple question: are your investments profitable? A higher ROI means – yes. A lower one means – no, at the moment at least.

[playht_player width=”100%” height=”175″ voice=”Mark”]

So naturally, the question being asked here is – how to increase ROI? We all want profitable businesses and investments, right?

While the answer is yes, it’s a bit more complicated than that.

ROI is an incredibly useful metric for tracking your success. But, as we progress through this article, we’ll see that fixating on it is not the best idea.

This article will take a look at what ROI is as a metric, highlight its advantages as well as its drawbacks, and discuss in which scenarios you may want to take measures to increase your ROI directly.

It will then take a look at one of the best applications for ROI – social media marketing. Social media marketing is, in itself, one of the best ways to increase your return on investment.

What is ROI?

How to calculate ROI

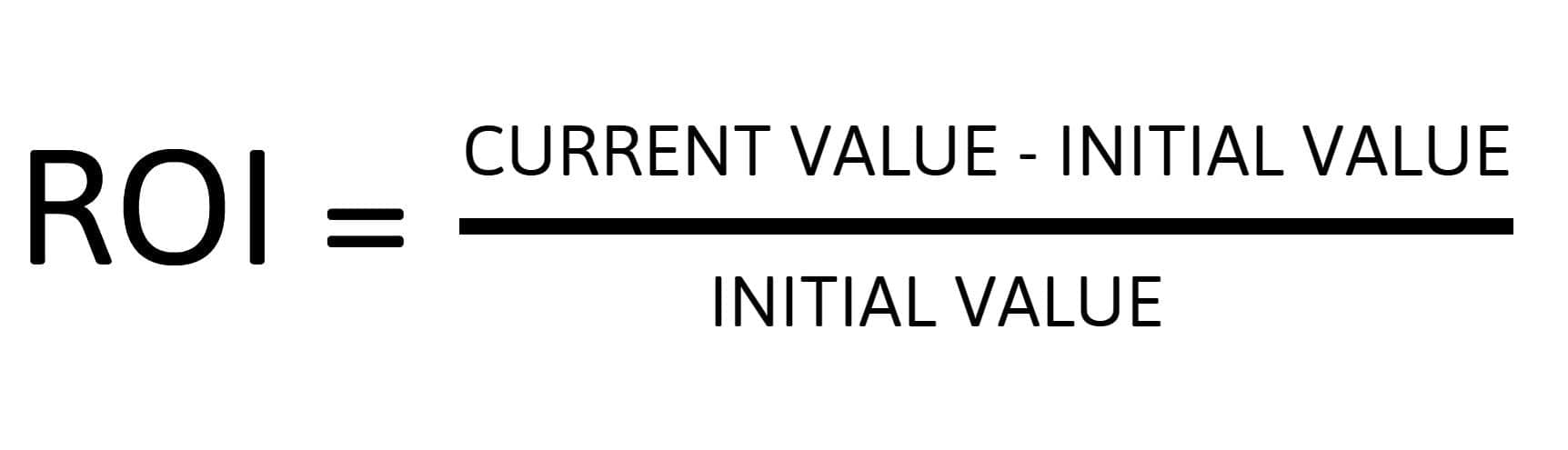

ROI is a ratio, most often expressed as a percentage.

You subtract the initial value of the investment from its current value, and you divide that with the initial value.

You can multiply the result by 100 to get ROI expressed as a percentage.

The ‘current value of investment’ is defined as the amount of proceeds you would get if you were to sell the investment at this moment.

ROI is an incredibly useful metric, allowing you to directly compare the value of investments, no matter how different in nature. It translates any type of business venture into the language of profit.

The benefits of knowing your current ROI

Calculating your current ROI can give you an excellent benchmark for future evaluations of your businesses and investments.

Put everything in the equation – the production costs, including materials and labor, overheads, marketing budgets, the lot, and compare it with what you’ve started with.

Use this as a milestone for any future adjustments you make to your business and inform all other investment opportunities.

What are the drawbacks of the ROI metric?

ROI takes the current cost of investment into account. Relying exclusively on ROI could make you miss opportunity costs.

Opportunity costs represent the chances you miss by taking one path instead of the other. An investment with a 30% ROI after three years can be less valuable than one with a 20% ROI after a year.

ROI also does not take inflation into account, nor does it calculate the rate of returns. Sometimes, an investment with a higher ROI may take longer to pay off. Concentrating solely on the ROI makes a more savvy business move look worse.

You should use additional metrics when evaluating your investments and business opportunities, such as the rate of return. You should also always account for inflation.

How do you get your ‘return’?

A higher return does not necessarily mean more significant sales numbers. You can yield higher profits by decreasing overheads and production costs by improving your employee retention, by developing stronger customer relations, optimizing for fewer government regulations, and many other aspects of the business.

These are all business aspects that can increase your ROI over an extended period of time.

You can define multiple benchmarks to track your ROI success. Try to be specific – don’t just track total revenue—track revenue over a certain period of time or on a certain geographical territory. You can track specific sales agents or distribution channels and set your goals accordingly.

Let’s discuss tactics that will boost your ROI in the most efficient manner.

Increasing revenues as a way to increase ROI

The most obvious way to increase your ROI is to boost your sales and prices without increasing the costs of production.

If the raised prices don’t erode your profits by depleting sales, this should increase your ROI evaluation.

Reducing production costs as a way to increase ROI

The other way around is obvious as well.

If you manage to reduce your production costs, your ROI will benefit without scaring away potential customers and losing loyal ones. That is, of course, if you haven’t lowered your product quality standards by a substantial margin or made a hostile working environment by reducing labor costs.

The best way to decrease costs is to decrease overhead expenditure. That means finding ways to pay less for rent, utility bills, insurance, and anything else that isn’t strictly production related.

Overheads are the most likely spot to find cost-cutting opportunities that will neither raise prices nor risk jeopardizing your business operation.

New types of ROI and putting things into perspective

ROI is a very straightforward metric. It lets you directly compare the value of your investments in a concrete manner – how much profit they are currently bringing to the table.

Low risk business ventures are usually tied to lower but more guaranteed ROIs. Higher risk moves carry with them the promise of a potentially high ROI but with higher chances for a negative ROI (i.e., losing money).

Recent developments in economic metrics have brought us tools that compare profits that are not directly measurable in dollar amounts. For example, social return on investment measures the impact that an investment makes on extra-financial values. These can range from raising social awareness about an issue to beneficial impacts on the environment.

Another type of ROI concerns digital marketing. Instead of measuring dollars and cents, social media ROI compares clicks and impressions between different marketing campaigns.

This serves as a great segway into one of the most efficient ways to increase your ROI – social media marketing.

Social Media Marketing and ROI

Using social media marketing to boost your ROI

Social media marketing may not boost your dollar value ROI straight away. This holds for all types of marketing ventures.

Marketing campaigns are used to raise awareness of your brand. That type of benefit is usually a more long term investment but can have a crucial role in your business’ survival, let alone your profits.

More than half of the world’s population has a social media account. There’s no denying that if you want your business to reach consumers and be profitable, your brand needs a social media presence.

Here are some of the benefits a social media campaign can bring, and how to :

- Generate income

- The goal of marketing campaigns is almost always to increase sales, long term or short term.

- When evaluating the ROI of your marketing campaign, ask yourself this question – how does the money you put into the campaign compare to the profit it generates?

- Increase brand awareness

- Marketing campaigns can be used to tell a compelling brand story. That way, new customers are introduced to your product, and you’re converting potential sales into real ones.

- Impressions are the metric that matter the most when calculating ROI from this angle. Measure your campaign’s efficiency by how many social media impressions they generate.

- Put your brand into a positive light

- Your social engagements paint a picture of a company that cares for the environment and society it operates in.

- The exact ROI is difficult to calculate for this aspect of social media marketing. You can make a survey or poll concerning public opinion about your company before the campaign starts and after it finishes. This will show you how much ROI in brand reputation your campaigns garner.

- Increase conversion rates

- You shouldn’t be satisfied with a higher traffic count on your site. You can’t have sales without traffic, but traffic without sales is just as useless. Marketing campaigns can have a huge impact on your conversion rates.

- Calculating the impact a social media marketing campaign has on your conversion rate ROI is fairly simple. There are hundreds of tools you can use to track your conversion rates, including Google Analytics. Simply compare your rates before and after the campaign.

Being creative increases your social media marketing ROI

The good folks over at McKinsey developed a metric to “have a quantitative measure that could be used to examine the linkage between creativity and business performance.” It’s called the Mckinsey Award Creativity Score (ACS).

Their research has shown that companies that have a high ACS have above average organic revenue growth. Two-thirds of them have increased return to shareholders, while three quarters enjoy a significant increase in ROI.

While we won’t get into the nitty gritty of just how their metric is made, we will acknowledge that creativity and originality is hard to define and quantify.

The thing is, even if you’ve put an enormous amount of resources into creating original content, there’s no guarantee you’ll get a return. And, to top it all off, when you do get a dissatisfactory result, you won’t know what went wrong.

If you’re a risk averse business owner, stick to tried and true marketing methods. However, if you see yourself as a risk-taking, trail blazing entrepreneur, investing in a creative team of marketers can net you a great ROI.

Moment marketing and ROI

What is moment marketing? Moment marketing is when brands use current events to raise their brand awareness by taking a stance.

It’s all about seizing the moment, creating content that is relatable and within the zeitgeist.

One of the most successful examples of moment marketing is the US brand Patagonia. In light of current ecological and environmental trends, as well as the 2008 global recession, they made a daring campaign.

During the ‘Don’t buy this jacket campaign’ launched in 2011, Patagonia highlighted the environmental cost of manufacturing new garments. They instead encouraged consumers to buy used products.

By 2012, the company saw a 30% increase in revenue.

Moment marketing is another high risk – high reward avenue for increasing your ROI via marketing.

Without proper guidance, brands can project an outdated or pandering image to the public. The worst that can happen is the company inadvertently taking a ‘wrong’ stance on an issue.

Before launching a moment marketing campaign, consult a professional marketer for the best course of action.

Personalized marketing campaigns as a strategy to increase ROI

Personalization means nothing more than narrowing the scope of your ad targets to the largest possible degree.

Big data and social media collect an unprecedented amount of information about each and every one of their users. This lends itself to highly personalized, targeted campaigns that are tailored to the individual consumer.

Personalization is much more than putting your target’s name in the email subject heading. The vast sea of data allows you to deliver a much more surgical and precise message to the intended consumer.

The name of the game is behavior tracking. Get to know your customer base using social media marketing tools and start narrowing it down until you get to the point of individual emails.

Personalized marketing campaigns are probably the best type of marketing you can do, but they are very labor and skill intensive.

They are, however, linked to revenue lifts of up to 15% and grant a 10-30% ROI increase on marketing campaigns.

Knowing how to increase ROI

Let’s sum up what we’ve covered.

ROI is a metric used to determine the profitability of an investment. It is usually expressed as a percentage and calculated with a simple formula that includes the initial investment amount and the value it yields.

ROI alone won’t tell you the complete picture since it only works with the investment’s value at the current moment. To get a fuller picture, make sure you adjust for time passage and inflation.

It is fairly awkward to suggest ways to increase ROI. Increasing this metric just means – doing better business. On the other hand, chasing an ROI increase alone can prove detrimental in the long run.

That being said, cold hard numbers are always appreciated. When the same concept is used in non-financial spheres of doing business, the metric gains new applications. Use ROI as it is – a tool of how good your business is doing and how savvy your investments are.